According to The NAR, These 10 Real Estate Markets May Boom in 2023

While the NAR predicts that the total price rise will be 0.3% for 2023, they believe Atlanta will be the top market.

Late in 2018, NAR’s Annual Real Estate Forecast Summit participants were allowed to voice their predictions for 2023. The forecast, developed by the Chief Economist of the NAR, Lawrence Yun, may be summed up as a year that would be sluggish for house sellers. Even if there is a minimal probability of a housing market disaster occurring right now, all of the present patterns point to next year, seeing a decrease in sales and a slower increase in house prices in most places.

Yun predicts numerous growing housing areas that will likely witness price rises in 2023, just like Austin and other cities did during the pandemic. These price hikes will probably be similar to the ones that Austin experienced.

According to the National Association of Realtors (NAR), the following metropolitan areas will be the most active housing markets in 2023:

In 2023, the South will be in the driver’s seat. According to Yun, “Southern states, almost without exception, fulfill the conditions of acceptable affordability, throughout, and high-paying employment being produced” (Southern states typically meet the requirements of reasonable profitability, in-migration, & high-paying jobs being created).

If investors in real estate wish to make the most of the possibilities presented by these markets before they ultimately become oversaturated, as has been the case in Austin, they should take notice of this tendency and act accordingly.

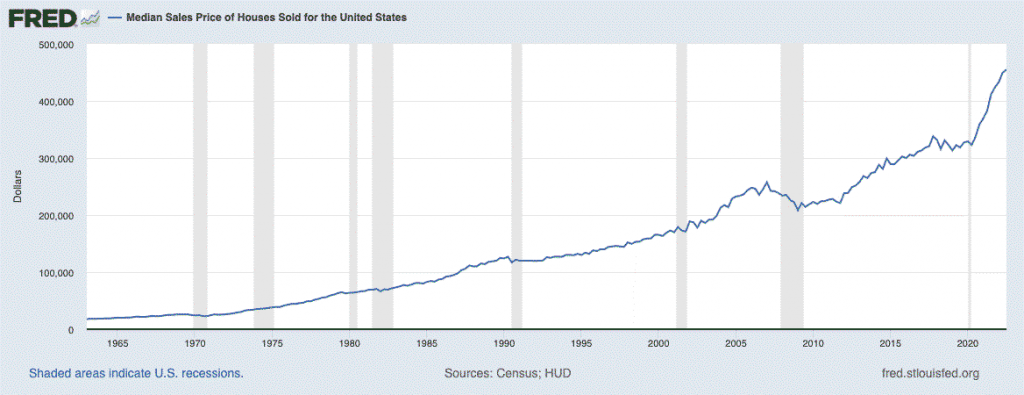

In 2023, it is anticipated that home price growth will halt, officially ending the Covid price bubble. The current forecast is for a modest gain of 0.3% on average, which would lower the national average house price to under $455,000. In essence, this indicates that the housing market is still expanding at a more modest rate.

According to the NAR, we have successfully sidestepped a catastrophic collapse or anything remotely resembling a catastrophe. The labor market has shown signs of continuing to be robust, specific markets’ prices have remained relatively unchanged, and inflation has started to fall. Yun points out that “today there are some layoffs in the mortgage business, and maybe the technology industry has stopped employing people, but if you look at the internet, there are still circumstances that favor the creation of new jobs.”

The housing and mortgage markets have also served as a crucial buffer against a market collapse. It is reasonable to argue that the housing market has become more resilient due to the tightening of borrowing laws that occurred in the wake of the subprime mortgage crisis in 2008. “During the previous cycle, subprime mortgages were widespread, often known as shady, dangerous, and self-reporting mortgages. According to Yun, “this time around, individuals are required to follow the new laws; therefore, this time around, we won’t have such dangerous mortgages.” The National Association of Realtors (NAR) forecasts that mortgage interest rates will drop below 6% sometime during the third quarter of 2023 and stay at that level until the end of the year.

In conclusion, the gap between supply and demand will not be closed shortly. This indicates that buyer demand will continue to prop up the economy for many months, keeping housing values stable in most areas except for California, which would be anticipated to undergo a significant decline in home prices of 10-15%. However, if you live in California, home prices are expected to remain stable.

The St. Louis Federal Reserve provides data on the median sales price of homes sold (1963-2022).

The most important forecast is that existing-home sales will continue downward through 2023. We have been following a decreasing trend up to 2022, and this tendency will likely continue. Existing house sales had a 16% year-over-year decline in 2022, bringing them to their lowest levels since 2014.

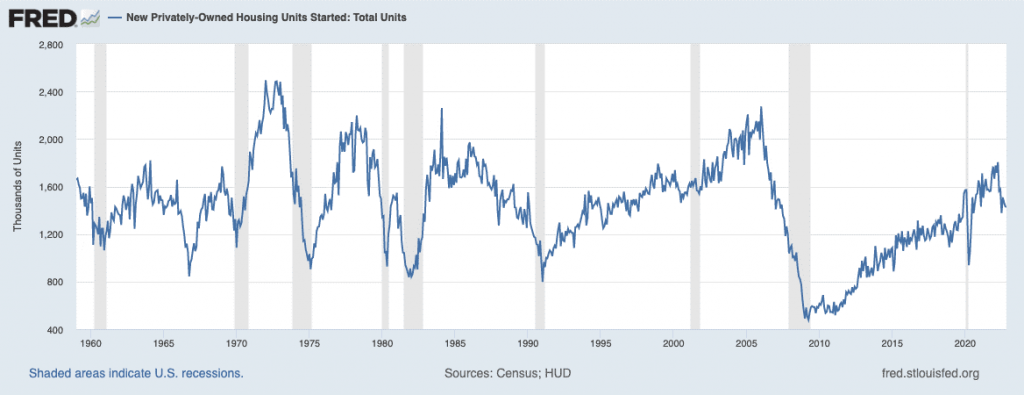

The number of newly constructed homes is showing improvement and is trending toward their historical norms. After suffering its biggest crisis in the wake of the financial meltdown of 2008, the market for new home starts has made a gradual but steady comeback over the last decade.

The general market is expected to continue its downward trajectory next year, which will be reflected in the slowdown of this sector of the housing market. However, new house sales are holding up better than existing home sales, as Yun points out. The subprime mortgage crisis caused a significant drop in sales of new homes, which has yet to be completely recovered. In addition to this, as a result, they had a low base reference against which to compare.”

The St. Louis Federal Reserve’s Estimate of the Number of New Housing Units Started That Are Privately Owned (1960-2022)